Fair Value Gap (FVG): A Fair Value Gap is essentially a range in price delivery where one side of the market’s liquidity is presented. It’s typically confirmed by observing a Liquidity Void on lower time frames in price charts, all within the same price range.This phenomenon can result in a literal price gap in the market. A Fair Value Gap occurs when the price swiftly moves away from a specific level, where trading activity is relatively scarce, creating a one-directional price movement.

There are several types of Fair Value Gaps, but we’ll focus on two significant ones here:

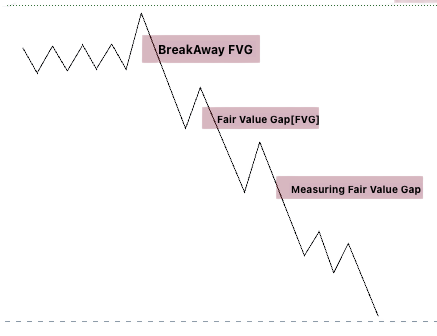

1. Measuring Fair Value Gap

This type of FVG serves as a significant indicator in market analysis. It plays a crucial role in determining market direction and order flow. When a Measuring Gap appears, it tends to remain open for an extended period. This is primarily because it signifies heavy institutional order flow, which propels prices consistently in one direction. In essence, a Bearish Measuring Fair Value Gap points to a dominant bearish order flow, while a Bullish Measuring FVG indicates a strong bullish order flow.

2.Breakaway Fair Value Gap

The Breakaway Fair Value Gap is another notable variant. It occurs in situations where the market experiences a sudden shift in sentiment, often accompanied by a significant gap in prices. This gap typically forms when the price breaks out of a trading range or consolidation phase. It is an essential signal for traders, indicating the potential beginning of a new trend. Similar to the Measuring Gap, the Breakaway Gap can appear in both bullish and bearish markets.

Liquidity Void: A Liquidity Void represents a price range where market liquidity is displayed predominantly on one side, leading to extended one-sided price ranges or candles. It happens when the market swiftly moves away from a consolidation phase, resulting in a lack of buy-side liquidity. In other words, there was minimal buying activity during this price movement. The nature of a Liquidity Void implies that, with a high probability, the price will eventually retrace and trade over the same price levels that previously lacked liquidity.

Understanding these concepts is essential for traders because Fair Value Gaps and Liquidity Voids provide insights into market inefficiencies. Traders can anticipate that the market will revisit these price levels before continuing in the same direction as the initial significant move. This knowledge empowers traders to find advantageous entry or exit points in the market, particularly for those who base their strategies on price action.